₹

0

All equity delivery investments (NSE, BSE), are absolutely free - ₹ 0 brokerage.

₹

20

Flat ₹ 20 or 0.03% (whichever is lower) per executed order on intraday trades across equity, currency, and commodity trades. Flat ₹20 on all option trades.

₹

0

All direct mutual fund investments are absolutely free — ₹ 0 commissions & DP charges.

About Zerodha

Zerodha Broking Ltd. is an Indian stock broker and financial services company that is a member of the National Stock Exchange of India (NSE), Bombay Stock Exchange (BSE), and the Multi Commodity Exchange (MCX). It offers institutional and retail brokerage, currency and commodity trading, mutual funds, and bonds.

Founded in 2010, the company is headquartered in Bengaluru and has a physical presence in many major Indian cities. As of May 2024, they have an active client base of 75 lakh customers registered with the NSE, giving them a market share of 17.5% and making them the 2nd largest broker in India.

Kite

Our ultra-fast flagship trading platform with streaming market data, advanced charts, an elegant UI, and more. Enjoy the Kite experience seamlessly on your Android and iOS devices.

Console

The central dashboard for your Zerodha account. Gain insights into your trades and investments with in-depth reports and visualizations.

Coin

Buy direct mutual funds online, commission-free, delivered directly to your Demat account. Enjoy the investment experience on your Android and iOS devices.

Kite Connect API

Build powerful trading platforms and experiences with our super simple HTTP/JSON APIs. If you are a startup, build your investment app and showcase it to our client base.

Founders

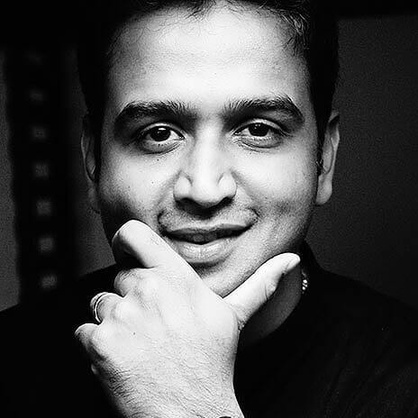

Founder, CEO

Nitin Kamath

Nithin bootstrapped and founded Zerodha in 2010 to overcome the hurdles he faced during his decade-long stint as a trader. Today, Zerodha has changed the landscape of the Indian broking industry.

He is a member of the SEBI Secondary Market Advisory Committee (SMAC) and the Market Data Advisory Committee (MDAC).

Playing basketball is his zen.

CO-Founder, CFO

Nikhil Kamath

Nitin Kamath

CTO

COO

Venu Madhav

Documents are required for a demat account with Zerodha

Documents are required for a demat account with Zerodha

These below documents are required to open an online account with Zerodha.

A Scan copy of required of PAN Card.

A Scan copy of required of PAN Card. A Signature required as per PAN Card on white paper.

A Signature required as per PAN Card on white paper. Proof of identification (POI) : PAN CARD, or Voter ID, or Passport, any ID card issued by the central or state government with applicant's photo.

Proof of identification (POI) : PAN CARD, or Voter ID, or Passport, any ID card issued by the central or state government with applicant's photo. Proof of Address (POA) : ADHAR Card, or Ration card, or Passport, or Voter ID, verified copies of electricity bills.

Proof of Address (POA) : ADHAR Card, or Ration card, or Passport, or Voter ID, verified copies of electricity bills. Bank Proof : Cancel cheque, or Bank Passbook or 6-month Bank statement

Bank Proof : Cancel cheque, or Bank Passbook or 6-month Bank statement Income Proof : 6-month Bank statement, or ITR with income Computation, or Salary Slip, or Net worth certificate or Copy of Form 16 or demat holding you may attach for derivatives segments.

Income Proof : 6-month Bank statement, or ITR with income Computation, or Salary Slip, or Net worth certificate or Copy of Form 16 or demat holding you may attach for derivatives segments.

If you are proceeding offline, then below are the documents required

Self-attested photocopy of the PAN

Self-attested photocopy of the PAN Self-attested photocopy of the Adhar card, Voter id, passport or driving license.

Self-attested photocopy of the Adhar card, Voter id, passport or driving license. 2 Passport size photo (Color).

2 Passport size photo (Color).  Original personalizes cancel cheque.

Original personalizes cancel cheque. Self attested photocopy required with your signature of 6 months bank statements, or ITR with Income Computation, or Salary Slip

Self attested photocopy required with your signature of 6 months bank statements, or ITR with Income Computation, or Salary Slip

Notes

- These documents are necessary for the KYC (Know Your Customer) process and to veri`fy` your identity and address.

- It is important to link your Aadhar number with the demat account because it is mandatory by the government of India.

- PAN and Aadhar Linking should be done as it is also mandatory by the government of India.

Account Opening Charges

| Segment | Charges |

|---|---|

| Trading & Demat Account Opening | Free for All Age Group |

| Annual Maintenance Charges (AMC) | 75 + 18% GST per quarter |

| DP Charges | INR 15.94 per script |

*Note: Zerodha account opening is free for all age groups including online and offline processes.

Brokerage

| Segment | Charges |

|---|---|

| Intraday | 0.03% or Rs 20 per order, whichever is lower |

| Delivery | 0 Brokerage on Delivery |

| Future | 0.03% or Rs 20 per order, whichever is lower |

| Option | Flat Rs 20 per order |

| Currency | 0.03% or Rs 20 per order, whichever is lower |

| MCX (Future) | 0.03% or Rs 20 per order, whichever is lower |

| MCX (Option) | Flat Rs 20 per order |

| Mutual Fund | Free |

*Note: Brokerage charges are applicable when your order executes successfully.

Statutory Charges – Equity

| Equity delivery | Equity intraday | F&O - Futures | F&O - Options | |

|---|---|---|---|---|

| Brokerage | Zero Brokerage | 0.03% or Rs. 20/executed order, whichever is lower | 0.03% or Rs. 20/executed order, whichever is lower | Flat Rs. 20 per executed order |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.0125% on the sell side |

|

| Transaction charges | NSE: 0.00322% BSE: 0.00375% | NSE: 0.00322% BSE: 0.00375% | NSE: 0.00188% BSE: 0 | NSE: 0.0495% (on premium) BSE: 0.0495% (on premium) |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) |

| SEBI charges | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

Statutory Charges – Currency

| Currency futures | Currency options | |

|---|---|---|

| Brokerage | 0.03% or ₹ 20/executed order, whichever is lower | ₹ 20/executed order |

| STT/CTT | No STT | No STT |

| Transaction charges | NSE: Exchange txn charge: 0.0009% BSE: Exchange txn charge: 0.0009% | NSE: Exchange txn charge: 0.035% BSE: Exchange txn charge: 0.001% |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) |

| SEBI charges | ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.0001% or ₹10 / crore on buy side | 0.0001% or ₹10 / crore on buy side |

Statutory Charges – Commodity

| Commodity futures | Commodity options | |

|---|---|---|

| Brokerage | 0.03% or ₹ 20/executed order, whichever is lower | ₹ 20/executed order |

| STT/CTT | 0.01% on sell side (Non-Agri) | 0.05% on sell side |

| Transaction charges | Group A Exchange txn charge: 0.0026% Group B: Exchange txn charge: CASTORSEED - 0.0005% KAPAS - 0.0026% PEPPER - 0.00005% RBDPMOLEIN - 0.001% | Exchange txn charge: 0.05% |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + SEBI charges + transaction charges) |

| SEBI charges | Agri: ₹1 / crore Non-agri: ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

** Charges Explanation is at the bottom of the page or click here to go there

Charges for Other Account Opening Except Retail

| Segment | Charges |

|---|---|

| NRI account (offline only) | ₹ 500 |

| Partnership, LLP, HUF, or corporate accounts (offline only) | ₹ 500 |

Charges for Optional Value-Added Services

| Service | Billing Frequency | Charges |

|---|---|---|

| Tickertape | Monthly / Annual | ₹ 500 |

| Smallcase | Per transaction | Buy & Invest More: ₹100 | SIP: ₹10 |

| Kite Connect | Monthly | Connect: ₹2000 | Historical: ₹2000 |

Securities/Commodities Transaction Tax

Tax by the government when transacting on the exchanges. Charged as above on both buy and sell sides when trading equity delivery. Charged only on the selling side when trading intraday or on F&O.

When trading at Zerodha, STT/CTT can be a lot more than the brokerage we charge. Important to keep in mind.

Charged by exchanges (NSE, BSE, MCX) on the value of your transactions.

Charged by exchanges (NSE, BSE, MCX) on the value of your transactions. BSE has revised transaction charges in XC, XD, XT, Z and ZP groups to ₹10,000 per crore w.e.f 01.01.2016. (XC and XD groups have been merged into a new group X w.e.f 01.12.2017)

BSE has revised transaction charges in XC, XD, XT, Z and ZP groups to ₹10,000 per crore w.e.f 01.01.2016. (XC and XD groups have been merged into a new group X w.e.f 01.12.2017) BSE has revised transaction charges for group A, B and other nonexclusive scripts (non-exclusive scripts from group E, F, FC, G, GC, W, T) at ₹375 per crore of turnover on flat rate basis w.e.f. December 1, 2022.

BSE has revised transaction charges for group A, B and other nonexclusive scripts (non-exclusive scripts from group E, F, FC, G, GC, W, T) at ₹375 per crore of turnover on flat rate basis w.e.f. December 1, 2022. BSE has revised transaction charges in M, MT, TS and MS groups to ₹275 per crore of gross turnover.

BSE has revised transaction charges in M, MT, TS and MS groups to ₹275 per crore of gross turnover.- ST BSE has revised transaction charges in SS and ST groups to ₹1,00,000 per crore of gross turnover.

Stamp Charges

Stamp charges by the Government of India as per the Indian Stamp Act of 1899 for transacting in instruments on the stock exchanges and depositories.

Call & Trade

BSE has revised transaction charges in M, MT, TS, and MS groups to ₹275 per crore of gross turnover.

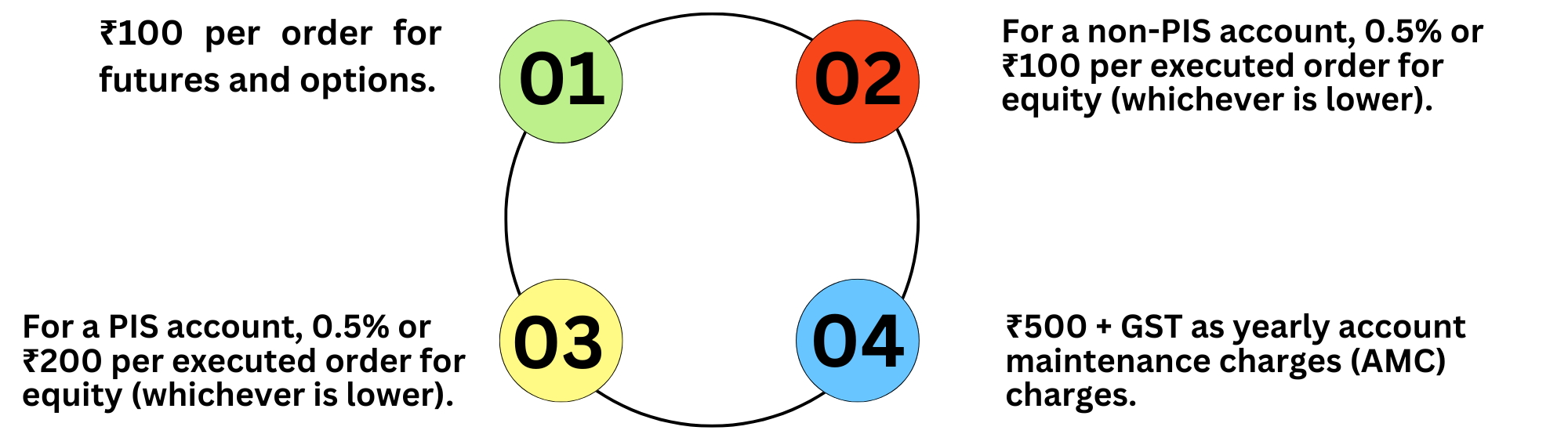

NRI Brokerage Charges

Account with Debit Balance

If the account is in debit balance, any order placed will be charged ₹40 per executed order instead of ₹20 per executed order.

Charges for Investor's Protection Fund Trust (IPFT) by NSE

01

Equity and Futures - ₹10 per crore + GST of the traded value.

02

Options - ₹50 per crore + GST traded value (premium value).

03

Currency - ₹0.05 per lakh + GST of turnover for Futures and ₹2 per lakh + GST of premium for Options.

GST

Tax levied by the government on the services rendered. 18% of ( brokerage + SEBI charges + transaction charges)

SEBI Charges

Charged at ₹10 per crore + GST by Securities and Exchange Board of India for regulating the markets.

DP (Depository Participant) Charges

For Males :

₹13 + GST per scrip (irrespective of quantity), on the day, is debited from the trading account when stocks are sold. This is charged by the depository (CDSL) and depository participant (Zerodha).

For Females :

- Female demat account holders (as first holder) will enjoy a discount of ₹0.25 per transaction.

- Debit transactions of mutual funds & bonds get an additional discount of ₹0.25.

Pledging Charges

₹30 + GST per pledge request per ISIN.

AMC (Account Maintenance Charges)

For BSDA demat account - Zero charges if the holding value is less than ₹50,000. To learn more about BSDA,

Click here

For non-BSDA demat accounts: ₹300/year + 18% GST charged quarterly (90 days). To learn more about AMC,

Click here

Corporate Action Order Charges

₹20 plus GST will be charged for OFS / buyback / takeover / delisting orders placed through Console.

Off-Market Transfer Charges

₹25 or 0.03% of the transfer value (whichever is higher).

Physical CMR Request

First CMR request is free. ₹20 + ₹100 (courier charge) + 18% GST for subsequent requests.

Payment Gateway Charges

₹9 + GST (Not levied on transfers done via UPI)

Delayed Payment Charges

Interest is levied at 18% a year or 0.05% per day on the debit balance in your trading account.

Disclaimer

For Delivery based trades, a minimum of ₹0.01 will be charged per contract note. Clients who opt to receive physical contract notes will be charged ₹20 per contract note plus courier charges. Brokerage will not exceed the rates specified by SEBI and the exchanges. All statutory and regulatory charges will be levied at actuals. Brokerage is also charged on expired, exercised, and assigned options contracts. Free investments are available only for our retail individual clients. Companies, Partnerships, Trusts, and HUFs need to pay 0.1% or ₹20 (whichever is less) as delivery brokerage. A brokerage of 0.25% of the contract value will be charged for contracts where physical delivery happens. For netted off positions in physically settled contracts, a brokerage of 0.1% will be charged.

| Zerodha Other Charges | |

|---|---|

| Demat and Courier charges | ₹150 per certificate (₹100 Courier charges also) |

| Pledging Charges | ₹30 per request + GST |

| Unpledging Charges | 0 |

| Cheque Bounce | ₹350 |

| Modification in CML | ₹25 per request |

Note : Interest at 18% per annum is charged on the outstanding bill amount if not paid within the due date.

Zerodha Pros and Cons

| Pros | Cons |

|---|---|

| Free account opening for all age groups. | Doesn't offer stock tips, research, and recommendations. |

| Most popular broker | No monthly unlimited trading plans |

| 0 Brokerage on Delivery | No lifetime AMC. |

| Easy understandable trading platforms | 3 in 1 account facility is not available |

| Self-Clearing Brokerage Bracket Order is not available (They don’t impose clearing charges to clients) | Bracket Order is not available |

| Auction Market order facility is available | |

| Participation in Govt Security facility available | |

| Minor Account facility available |

Zerodha Broking Limited Registration Details

| SEBI Registration no | SEBI Registration no INZ000031633 |

| CDSL Registration No | IN-DP-431-2019 |

| NSE TM Code | 50001 |

| MCX | 46025 |

Notes

Notes

- A.

Remat :Remat stands for rematerialization. In this process you can get your electronically held securities converted into physical certificates by processing your request via Zerodha.

- B.

SEBI Risk Disclosures on Derivatives :

- 9 out of 10 individual traders in equity Futures and Options Segment incurred net losses.

- On average, loss makers registered net trading losses close to ₹50,000.

- Over and above the net trading losses incurred, loss makers expended an additional 28% of net trading losses as transaction costs.

- Those making net trading profits incurred between 15% to 50% of such profits as transaction costs.

- C.

Minor & Major Account - (There is no minimum age to invest in the stock market. Both a minor and an adult can invest in stocks.)

For individuals below 18 years, parents can open a minor account for their children by submitting the necessary documents (parents or the appointed guardian). The parents or guardian/s will be in charge of the account until the minor reaches adulthood. Upon turning 18, the depository participant will send a notification to migrate the minor account to a major account.